Overview

I joined the small team of two at Insyde as the founding designer, where our vision was to improve access to financial advice for young people. As the founding designer, my role was to bring this vision to life, by creating an iOS MVP, developing relationships with our early adopters, and implementing user research to design new features. But beyond my contribution to the user experience, I was deeply involved in defining our path to profitability: planning out our immediate revenue streams and our blueprint for long-term sustainable revenue.

What was Insyde?

Insyde was an early-stage social investing startup targeting Gen-Z and Millennials (18-35) who were new to investing.

The problem Insyde was attempting to solve was improving access to financial advice, which in turn would allow people to get started on their investing journey.

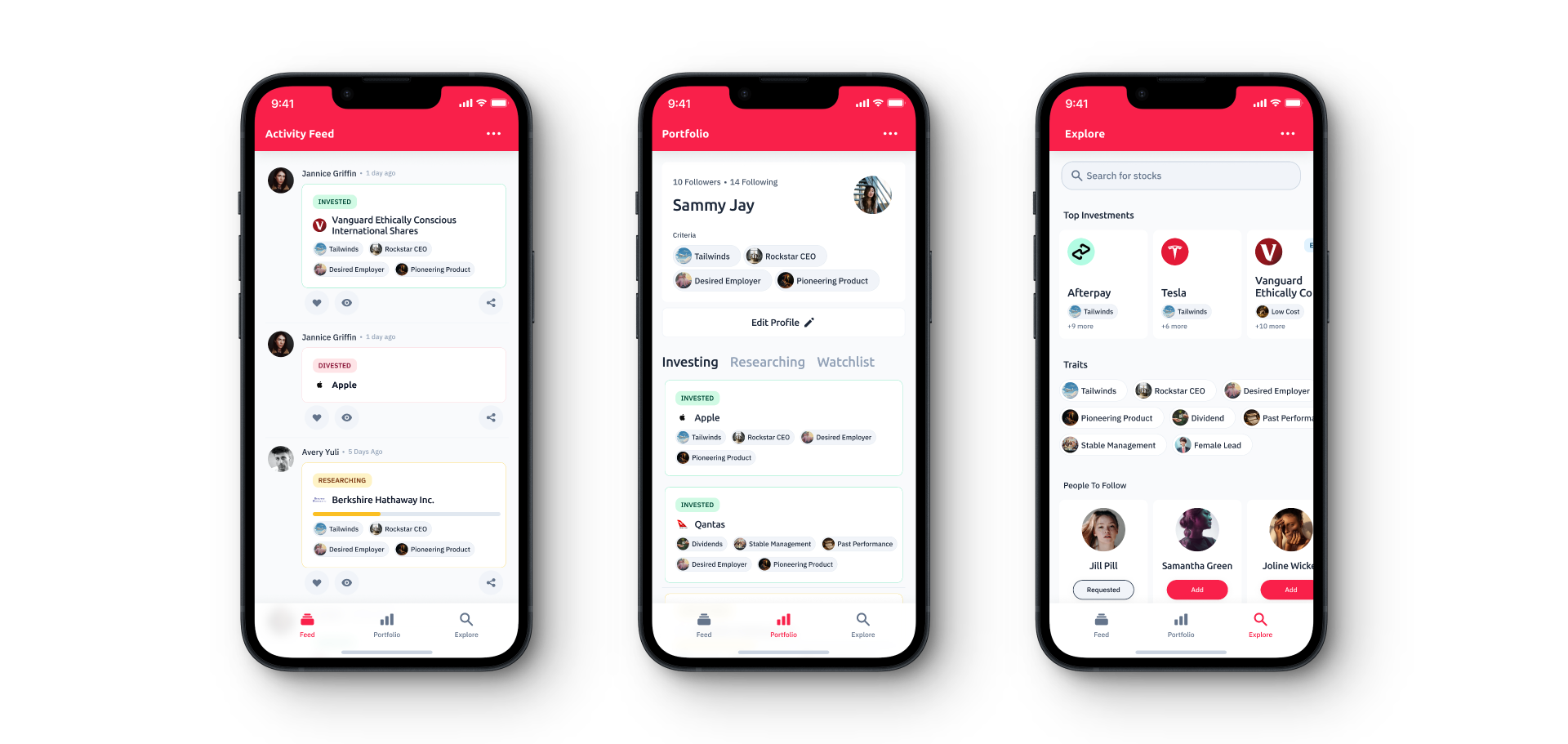

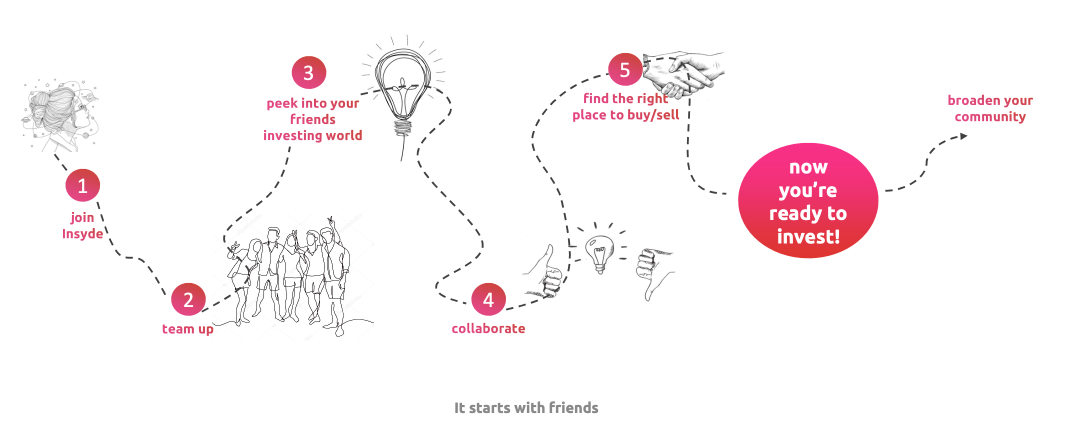

The solution was a social platform where users could share potential investments, get feedback from their private community on their portfolios, and encourage each other. Insyde worked on the assumption that young people wanted to get started with investing but lacked trusted advice. Initial research also pointed to an increasing appetite amongst this cohort of sourcing financial advice primarily from peers and social media, unlike older generations who habitually turned to news media or employed financial advisors.

Launching our MVP

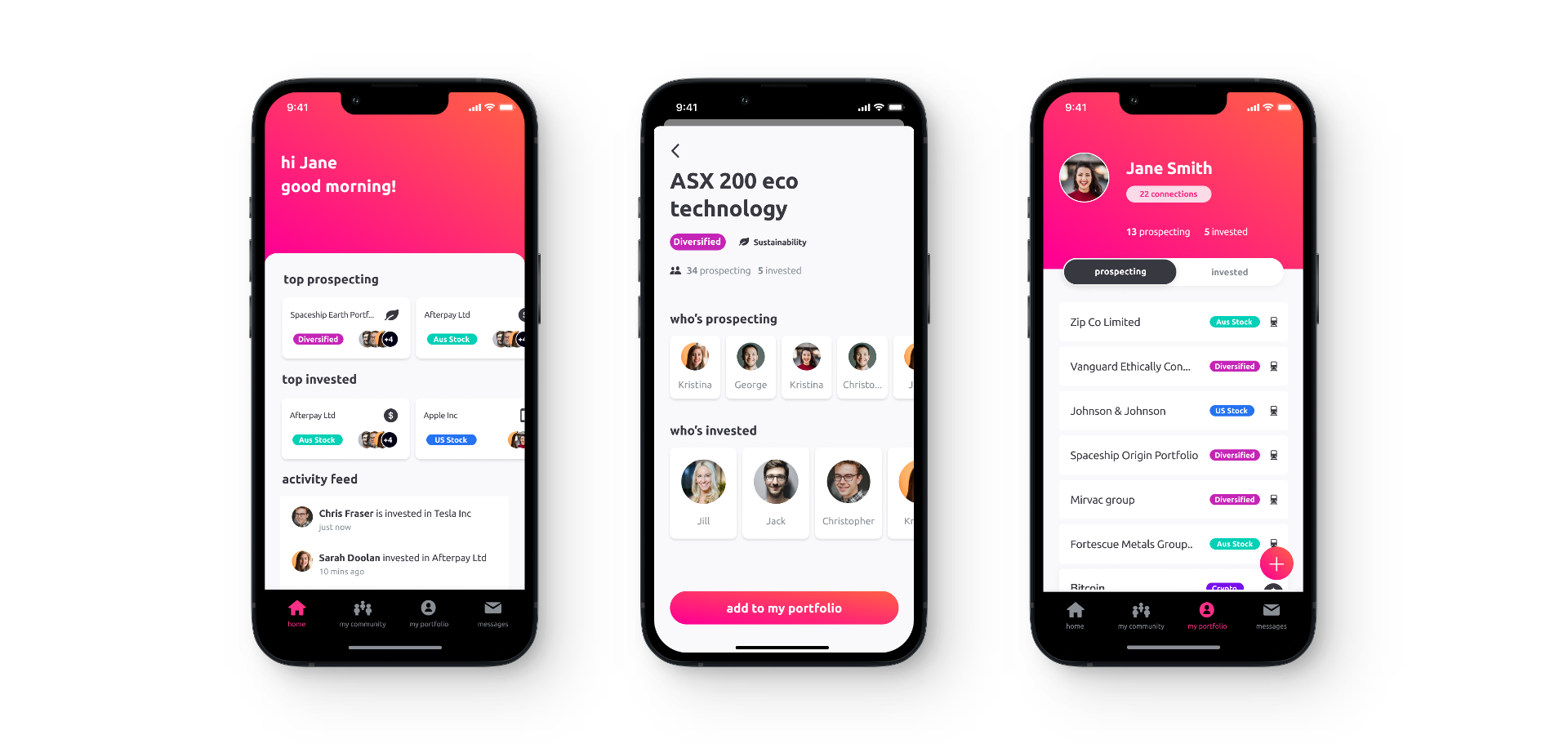

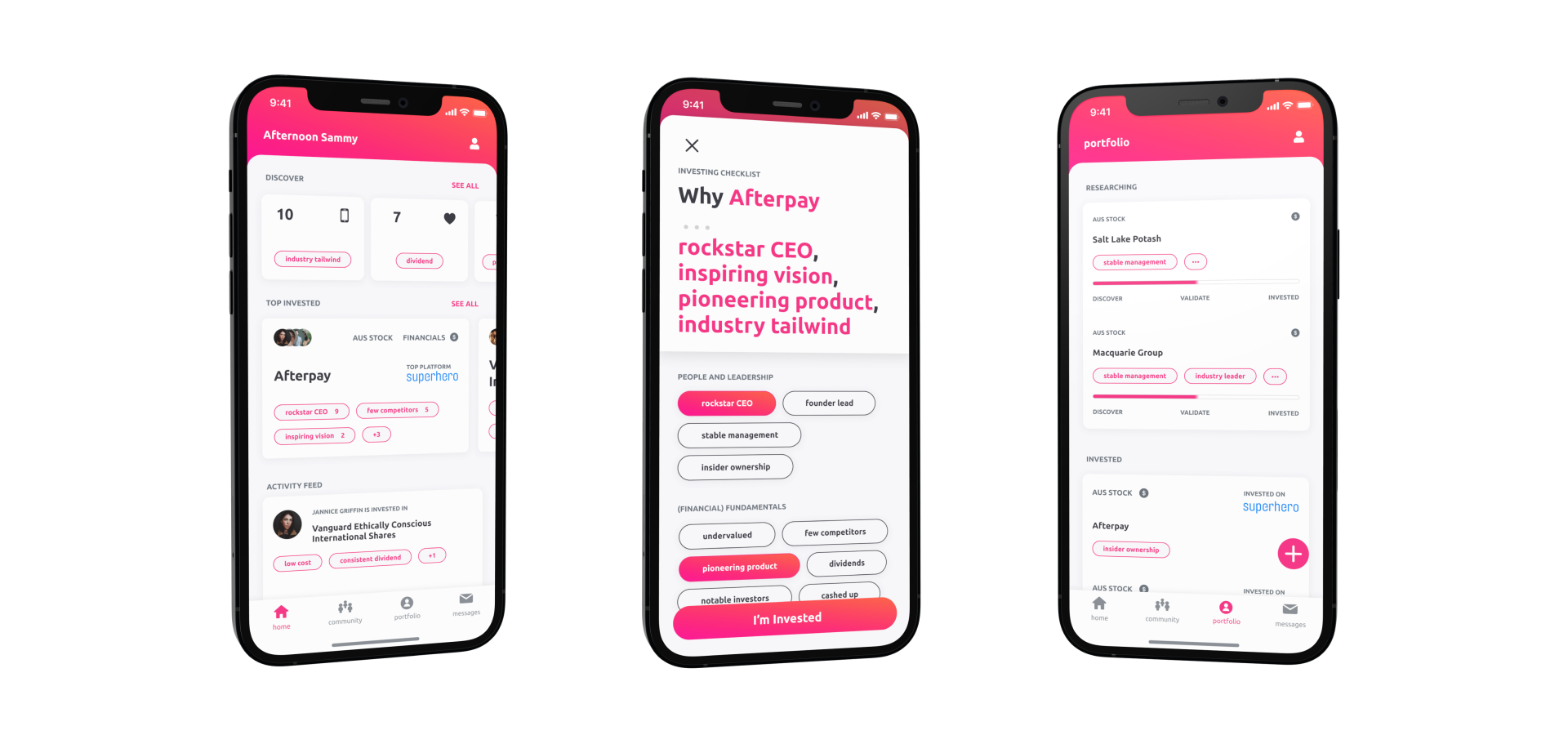

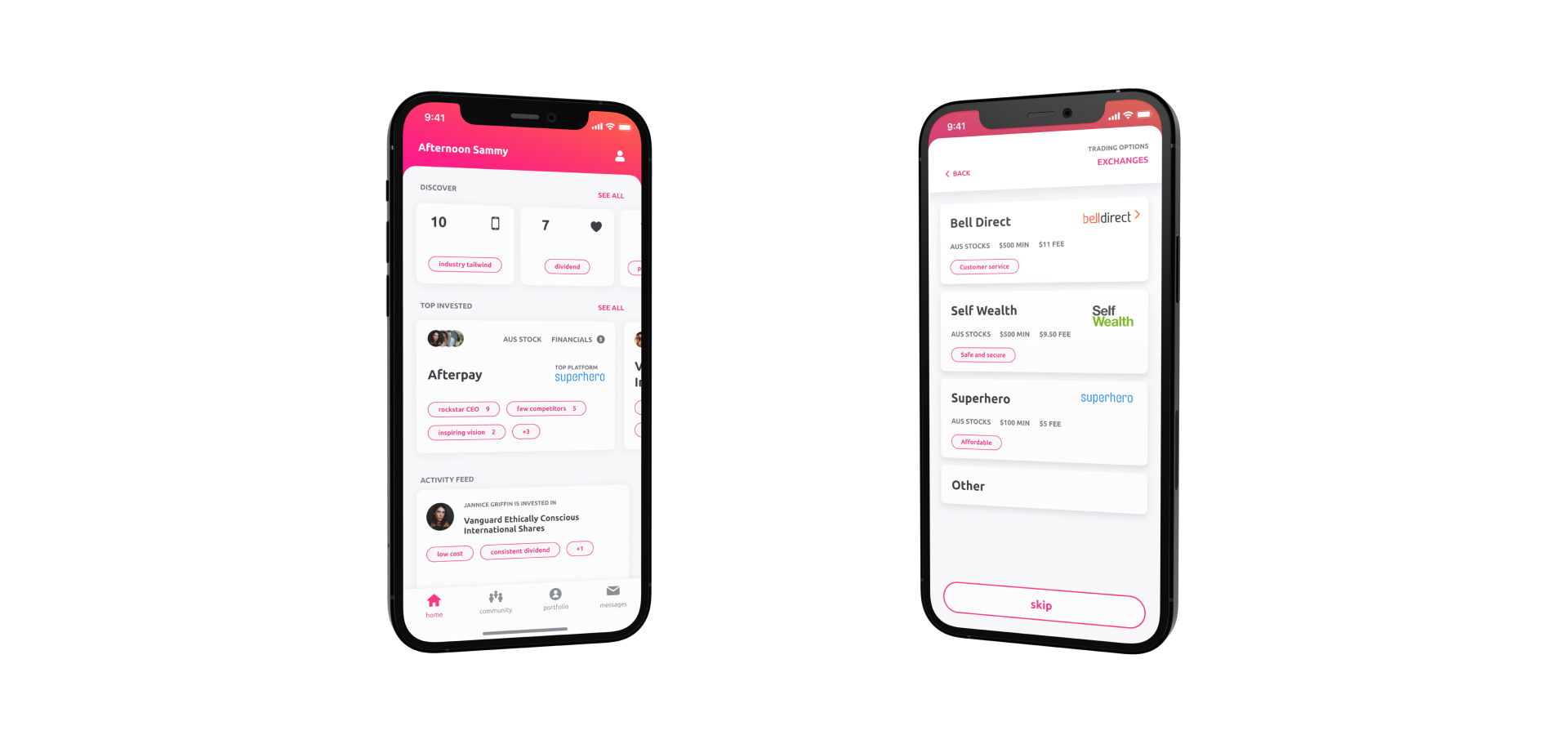

The MVP was basic, entailing: an activity feed, a list of most common investments, and a list of the most prospected equities (a watchlist) across their Insyde connections/community This gave us a good indicator of our users' appetite for peer to peer financial advice.

The Insyde iOS app was free to download and marketed on Instagram, so we were able to grow the user base to a couple hundred users within a week. I surveyed all our early adopters to learn about their backgrounds and connected with 15 early adopters for in-depth interviews on their previous investing experience and strategies. I continually referred back to this group to test and gain feedback on any of our app developments.

The most interesting takeaways:

🔮

Investing strategies were often narrative-based rather than quantitative-based.

Narratives around growth, ESG factors or other story-driven factors were the primary driving influences on whether or not to invest. This remained a trend even amongst those with a background in finance or those working in the industry.

📈

Data on equities were requested but not valued.

Live stock data and related news were commonly requested. However when questioned on how impactful this information was on their investing habits, most indicated they wouldn't be willing to pay for this information as it is freely available on many other platforms.

🪤

Social investing has an engagement problem.

Just like any social platform, only a minority of users are sharing content. However, this problem is more acute on a platform sharing investing activity where on average, retail investors only make 4 trades a year, and sharing portfolio adjustments may not always be flattering.

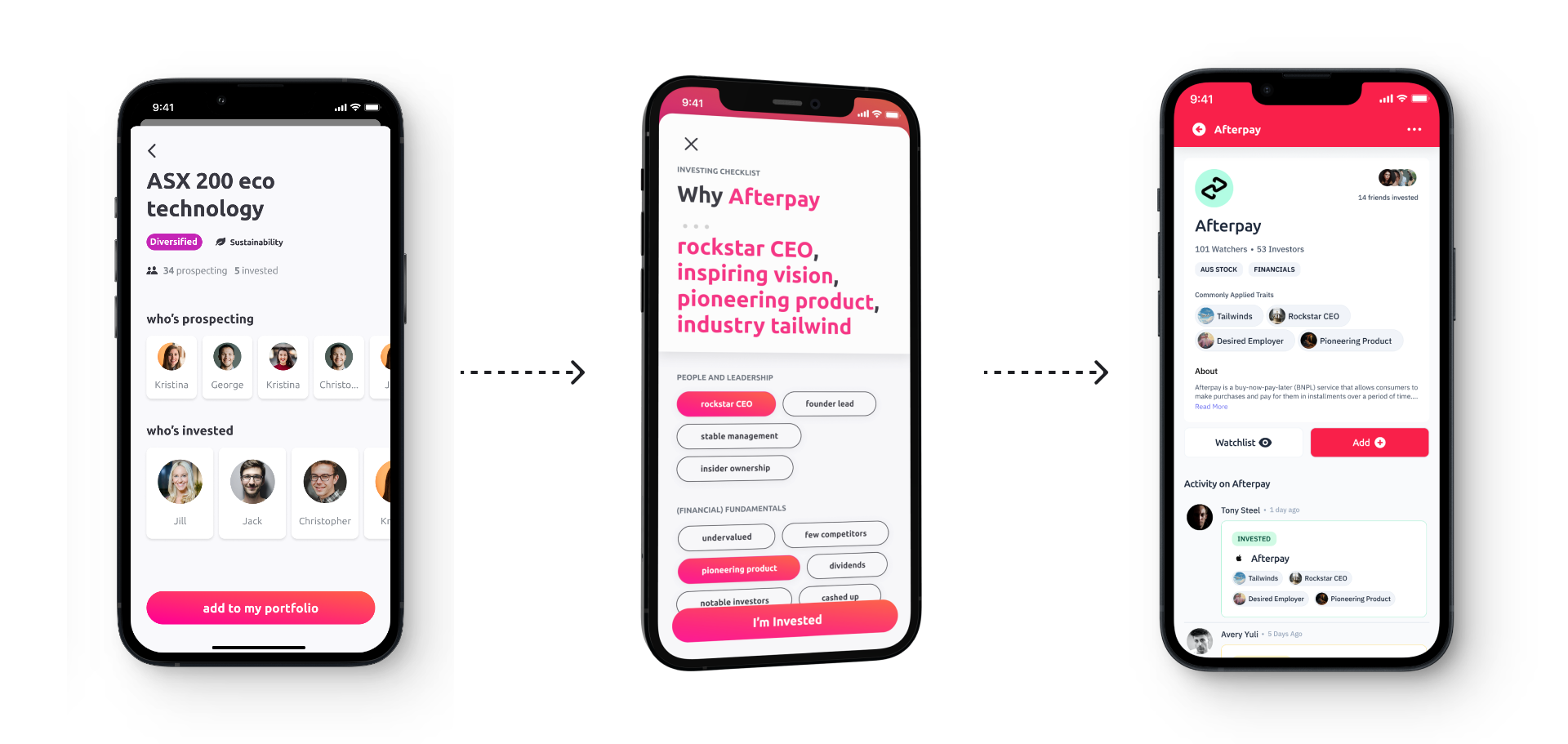

Based on these insights, we refrained from adding technical financial information (e.g. price charting, PE ratios) to the app and instead introduced a categorisation feature called ‘Traits’. With Traits such as “Climate Leader” or “Female Led”, users were able to quickly find new investments which best resonated with them. This investing framework helped our users create an investing style of their own and share their strategy/values with their community.

Path to Profitability

Our immediate plan for revenue was to seek referral fees from stock brokers when a trade was initiated via the Insyde app. As observed on the website Finder, referral fees were high for financial products, making referral fees an attractive starting revenue source for Insyde. We formed agreements with two brokers who could cover both Australia (ASX) and the US markets.

In this process we discovered that seeking recurring referral fees from brokers was unlikely and more importantly, this method fragmented our user experience. This revenue method was not well received by our users, so we doubled our efforts to find a long-term revenue solution.

We determined that seeking a ‘funds under management’ fee was the best long-term revenue source for Insyde, being successfully applied to the same group of users by other fintech services such as Raiz and Spaceship. Putting money into a fund and watching it grow with the market is a frictionless experience and can be a great source of revenue if scaled.

The plan was the Insyde app would allow users to ‘copy trade’ the sum of the investing activities of their Insyde community , rather than users having to make individual trades themself. This feature had particular potential amongst our newer users, as it meant that they did not have to make the first (often daunting) step alone. This ‘copy trading’ feature was effectively an index fund which followed the tastes of our younger audience, so we affectionately named it the "Fund of the Future" ETF.

However, this revenue strategy was only possible if Insyde reached a certain scale and was capable of complying with Australian laws. With this in mind, we needed to prove a product-market fit to raise the external funds needed to nurture the platform to scale.

Core Product Problems

After releasing incremental updates, it became evident that Insyde did not have a clear product market fit. From speaking to users and viewing their engagement, there were a few reasons we started to doubt that we were solving a problem for our target users.

🛍️

There were simpler options available with excellent user experience

Other existing platforms were ‘Raiz’ and ‘Spaceship’ for simple investing, ‘Stake’ for stock picking, and ‘Vanguard’ for ETFs. Both ‘Raiz’ and ‘Spaceship’ covered a significant portion of the new investing space and satisfied their desire to take some basic actions with their money.

🎰

Stock picking isn’t for everyone

Insyde was targeted at those who were ‘new to investing’ however, the platform’s most active users ended up being those who were trading enthusiasts and therefore had significantly different needs and risk tolerance. This mismatch put into question if our ‘new to investing’ audience was benefiting from our most active users’ trading activity.

🚩

User enthusiasm is not the same as user action

Users initially exhibited a keen enthusiasm for discovering new equities and ways to invest. However after unsupervised testing and extensive interviews, users’ self-reported interest in discovering and researching stocks was not backed up in actual investing.

Final Thoughts

We concluded that investing was a form of preventative medicine, for a problem that isn’t immediately obvious to a majority of young people (18-35). Similar to people’s feelings on personal fitness, when asked, most young people say they would like to be more active than they are currently. However, positivity or optimism should not be interpreted as a conviction to act, as the reality of improving your personal fitness - or in this case, your finances - is consistency and (sometimes) tedium over long periods.

Investing can appear abstract from financial wellbeing. Risk, time and effort in the short term isn’t appealing to users whose immediate lives don’t depend on improving their financial standing in 5 to 10 years. In other words, long term investments were seen as a problem for another day.

We investigated pivots for the business ranging from generating bespoke portfolios from profile activity, using our community data to create a superannuation product, turning into a trading platform, and gamifying dollar-cost averaging.

Despite this, evidence was mounting that there was no clear product-market fit in the medium term, meaning we could not, in good conscience, raise capital. As a result, Insyde shut down at the end of 2021 💀